7 Programs That Can Pay Your Bills in 2024

Are you struggling to keep up with your bills? Imagine if the government or another organization could step in and cover some of those essential expenses like your phone bill, utilities, or even your rent. It sounds too good to be true, right? Well, it’s not. Here are 7 programs that can help you pay your bills and lighten your financial load.

1: Lifeline Program: Erase Your Phone Bill

The Lifeline program can help you eliminate your phone bill. Contrary to popular belief, Lifeline is still available and going strong. It offers a $9.25 subsidy monthly on your phone or internet service. If you live on tribal lands, you could get up to $34.25 in savings each month. Many Lifeline providers offer phone plans that cost $9.25 monthly, meaning your service could be free after applying for the subsidy.

You can qualify if you receive benefits from other means-tested programs like SNAP, Medicaid, or SSI. Alternatively, if your household income is 135% of the federal poverty level or less, you can also qualify. Apply at lifelinesupport.org.

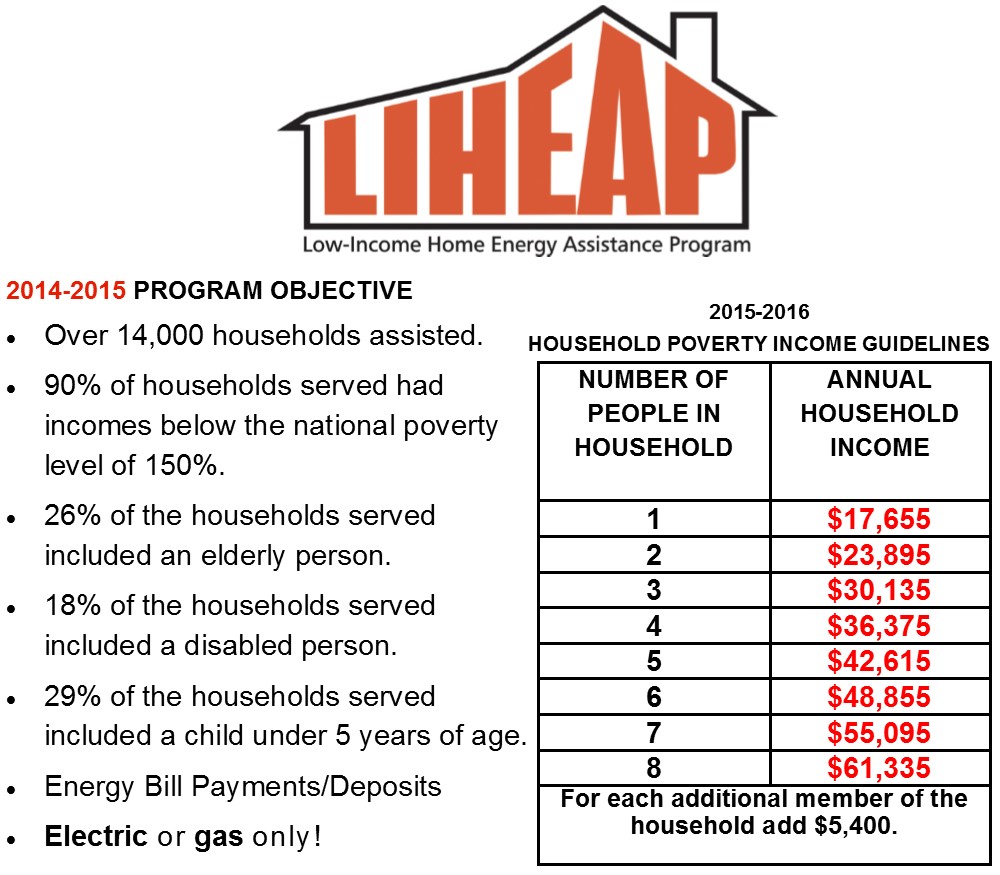

2: LIHEAP: Cut Your Utility Bills

Heating and cooling costs can be a huge burden. The Low-Income Home Energy Assistance Program (LIHEAP) can help you reduce these costs by up to $1,000 annually. LIHEAP provides grants to states to help eligible households pay their energy bills.

To qualify, your income must be below 150% of the federal poverty level, or you must receive benefits from programs like SNAP or SSI. Contact your local Community Action Agency or state Social Services Agency for more information. Apply Application online at https://www.benefits.gov/benefit/623

3: Housing Assistance: Tackle Rent and Mortgage Payments

Housing costs often consume a large part of your budget. Programs like the Housing Choice Voucher Program, or Section 8, offer significant rental assistance. Though waitlists can be long, it’s wise to apply early.

Many states and cities also offer other rental assistance programs with shorter wait times. Check with your local Housing Authority or Social Services Agency for more details. Veterans can benefit from the HUD-VASH program, which combines housing vouchers with case management and clinical services from the Department of Veterans Affairs. find rental assistance programs.

Interestingly, some Medicaid plans provide up to $500 annually toward your rent or mortgage payments. Contact your Medicaid provider to discover if you qualify.

4: Save Plan: Manage Your Student Loan Payments

Student loan debt can be overwhelming. The SAVE plan (Saving on a Valuable Education) significantly reduces or eliminates your student loan payments. More than 4 million borrowers have already lowered their payments to $0 per month under this plan.

SAVE adjusts your monthly payments based on your income and family size, preventing your loan balance from growing even if your payments don’t cover the interest. Enroll through the federal student aid website.

5: Non-Profit Credit Counseling: Regain Financial Control

Debt can come in many forms, including credit card bills and medical debt. Non-profit credit counseling agencies can help you tackle your debt. These agencies offer financial education, budgeting services, and debt management plans.

A certified credit counselor can create a personalized plan to tackle your debts and negotiate with creditors to lower your interest rates. To find an approved agency, use the tool available at justice.gov.

6: Water Assistance Programs: Reduce Your Water Bill

Water bills can also add to your financial stress. Many states have water assistance programs to help you pay these bills. Contact your state government or Community Action Council to learn more.

7: Additional Medicaid Benefits: Unexpected Financial Help

Your Medicaid plan might offer more than basic healthcare. Some plans provide financial assistance for utilities, transportation, groceries, and school supplies. Specific benefits and amounts can vary, so check with your Medicaid provider for details and visit the Medicaid website.

Conclusion

Financial struggles are tough, but these seven programs can provide some much-needed relief. Whether it’s your phone bill, utilities, rent, or student loans, there is help available. Apply as soon as possible to take full advantage of these opportunities and lighten your financial load.